HSBC’s profits increased significantly and they distributed $3 billion to shareholders, thanks to the implementation of higher interest rates. However, MPs were critical of the top UK banks for not compensating savers quickly enough.

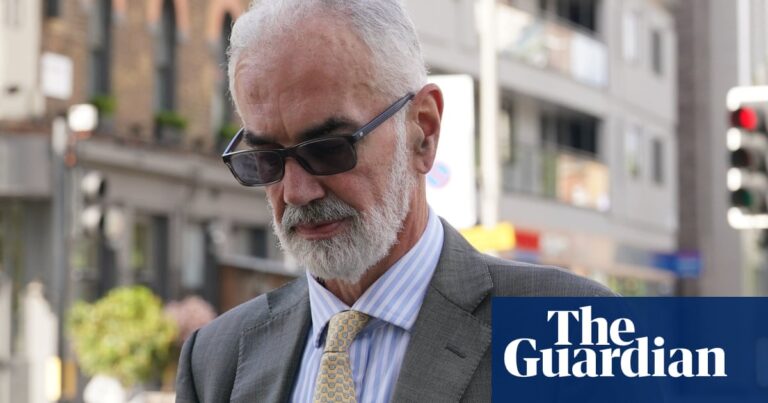

The bank based in London announced that it will initiate a share repurchase and distribute a dividend of 10 cents per share. The chief executive, Noel Quinn, praised the bank’s “exceptional financial performance” over the last three quarters.

HSBC announced that it had generated $7.7 billion in pre-tax profits during the months of July to September. This amount was lower than the anticipated $8.1 billion by analysts, but it was still over twice the $3.2 billion earned by the bank in the same timeframe in the previous year.

The increase in profits was driven by a 15% growth in net interest income, which reflects the gap between the interest charged on loans and mortgages and the interest paid to savers. This resulted in a total of $9.2 billion, as interest rates continue to rise.

The Treasury committee received backlash from MPs for failing to increase savings rates at the same pace as mortgage charges.

Investors have expressed dissatisfaction with the net interest margins of UK banks, whether due to a current decline or predicted decrease. This indicates that the difference between mortgage rates and savings interest payouts is becoming smaller. However, the committee argued that lenders are not taking sufficient action.

Harriett Baldwin, chair of the Treasury committee, stated that the major banks have been inadequate in providing better interest rates for instant access savings accounts to benefit savers.

The Conservative Member of Parliament acknowledged that there were intelligent customers who were switching to rival banks for better interest rates. However, they also stated that recent data suggests that banks are making minimal efforts to incentivize our constituents to save.

She stated that they will persist in advocating for individuals and businesses to be incentivized for saving. In the meantime, it is recommended for savers to compare rates and find the best option.

The increase in earnings helped balance out the $1.1 billion reserved by HSBC for potential loan losses. This amount includes $500 million related to the unstable commercial real estate market in China, where HSBC generates most of its profits and has a $13.6 billion risk exposure.

HSBC executives stated that although the Chinese real estate market is not expected to deteriorate further, the recovery will be gradual.

“The recent changes during the summer have not met our initial expectations, especially following the Covid lockdown,” stated Georges Elhedery, the chief financial officer. “Moving forward, we foresee a few more challenging quarters as the sector adapts. However, we are optimistic about the policy actions being implemented to alleviate the strain on the sector and help it overcome this obstacle.”

On Monday afternoon, the value of HSBC stock dropped by 2.7%, causing it to be one of the top decliners on the FTSE 100 index.

On the previous Thursday, the stocks of HSBC’s competitor Standard Chartered dropped by over 11% due to the announcement that its pre-tax profits had decreased by more than half as a result of its involvement with China.

Bypass the newsletter advertisement.

after newsletter promotion

HSBC expressed optimism for its UK operations, which saw a significant increase in pre-tax profits of $1.8 billion, driven by a 20% growth in revenues and a decrease in provisions for potential defaults.

“We are delighted to observe the strong resilience of the UK economy in recent quarters and remain optimistic about its future resilience,” Elhedery stated. “While we will closely monitor factors like unemployment and inflation as indicators of our performance, we are overall very satisfied.”

HSBC’s mortgage customers have been utilizing forbearance options for their home loans due to the current high cost of living. However, the company’s finance chief has stated that this only makes up less than 0.3% of their customer base in the UK.

According to Elhedery, the consumer-oriented businesses within the commercial bank pose the greatest danger as spending on non-essential items has decreased due to inflation. However, he noted that overall, there has not been a decline in this sector, with only a few exceptions.

HSBC allocated $58 million to protect itself from potential losses on loans in its UK sector, a significant decrease from the $279 million set aside in the previous year.

Russ Mould, the investment director at AJ Bell, said: “Given the difficulties faced by the Chinese economy in 2023, a key market for HSBC, its level of performance has been impressive. To sustain this, CEO Noel Quinn’s observation that China’s commercial property market has bottomed out will have to prove accurate.”

Quinn, who earlier this year quashed proposals by its largest shareholder, Ping An, to spin off the Asian business, said new investors were being drawn to HSBC as a result of its strong financial position.

In March, HSBC acquired Silicon Valley Bank’s UK operations for £1 as a means of saving the lender for British technology startups.

Source: theguardian.com