According to Lloyds Banking Group, the housing market in the UK is expected to experience a decline throughout this year and in 2024, with a projected recovery not occurring until 2025.

The lender, which owns Halifax and is Britain’s largest mortgage provider, said that by the end of 2023 UK house prices would have fallen 5% over the course of the year and were likely to decrease by another 2.4% in 2024.

The predictions, which came out with the company’s financial report for the third quarter on Wednesday, indicate that UK house prices will have dropped by 11% from their highest point in the previous year, when the market was driven by a demand for bigger homes due to the COVID-19 pandemic.

Santander forecasts that UK house prices will decrease by 7% in 2023 and then by 2% in 2024.

The initial indications of growth are expected by both lenders to appear in 2025. Lloyds economists anticipate a 2.3% increase in house prices, while Santander predicts a 2% rise.

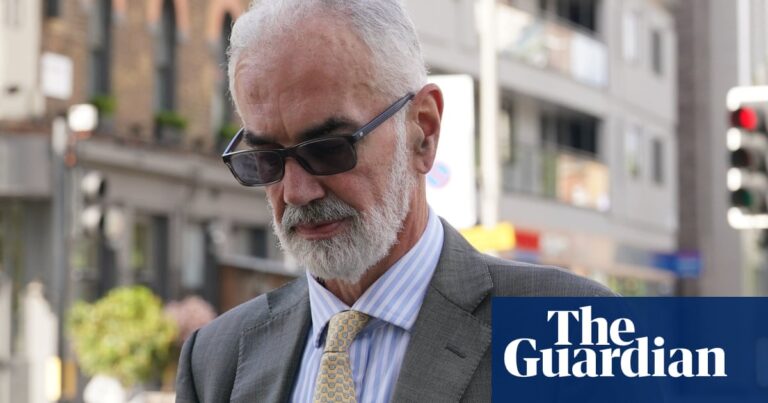

According to William Chalmers, the chief financial officer of Lloyds, the housing market in 2023 is not as strong as it has been in past years. However, he notes that there has been a general increase in the housing market for several years now, so the market is simply reverting back to previous levels.

In the meantime, Lloyds announced that its financial situation was under pressure due to the increase in interest rates being paid out to its depositors.

In the third quarter, Lloyds reported a decrease in its net interest margin, which is a significant factor in the bank’s revenue and reflects the contrast between mortgage rates and savings rates. This decline, from 3.14% to 3.08%, was attributed to anticipated challenges in mortgage and deposit pricing. Chalmers noted that this trend is likely to persist in the following quarter.

Due to competition, lenders are now lowering expensive mortgage rates and offering higher payouts for deposits. This is due to savers who are searching for more profitable returns.

Regulators and politicians have put pressure on banks this year, accusing them of not promptly passing on interest rate increases to their savings customers while quickly raising charges for borrowers.

Lloyds was able to announce an increase in pre-tax profits to £1.9bn for the third quarter, compared to £576m in the same period last year. However, this number has been adjusted to comply with updated accounting regulations.

Skip over the promotion for the newsletter.

after newsletter promotion

The company’s profits were boosted by a 72% drop in the funds reserved for potential defaults, totaling £187m. This is significantly lower than the £668m set aside in the same time frame last year, when the company proactively prepared for a potential economic downturn that could impact the housing market in the UK.

According to Lloyds, there has been no significant change in the number of customers who are struggling to make their mortgage payments during the third quarter. While there has been a decrease in the number of defaults, they are still slightly higher than before the pandemic.

Santander additionally reported a slight rise in the number of customers struggling to make mortgage payments, but noted that it anticipates longer-term interest rates to have a stronger effect on both individuals and businesses in the future.

Chalmers stated that Lloyds is actively contacting customers to provide debt counseling and potentially transfer some borrowers to more favorable interest rates. He described it as a comprehensive outreach effort by the bank to ensure that those in need of assistance receive it.

Source: theguardian.com