According to a report, the US has become a safe haven for illicit funds obtained by those who commit environmental crimes in the Amazon rainforest due to lack of transparency and inadequate supervision.

A report states that unscrupulous loggers and miners are using US real estate and other assets to store large sums of money, ranging from millions to billions of dollars. The report urges Congress and the White House to address gaps in financial regulations that are contributing to the destruction of the world’s largest rainforest.

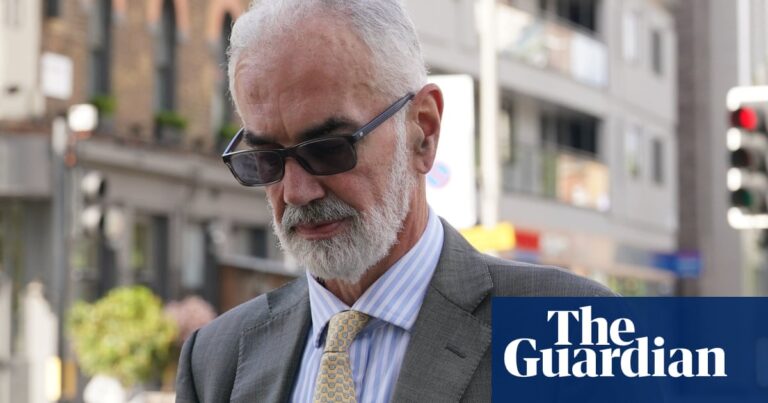

Ian Gary, the executive director of the Fact Coalition, stated that the United States is the most convenient location for concealing illicit funds. This poses a significant issue not only for national security, but also for drug trade, corrupt practices, and environmental crimes. The Fact Coalition was responsible for creating the report.

In 2021, the US has been ranked at the top of the world financial secrecy index published by the Tax Justice Networks. This is due to its issues with money laundering and loopholes in its laws regarding financial transparency.

The Fact study highlights the influence this has on environmental offenses in the Amazon, a significant area in terms of its effect on the climate. The document presents six instances where there is a connection between deforestation and American corporations.

The state of Florida, which shares deep cultural and linguistic ties with South America, was identified as a significant location. The study highlights the example of Goldex, previously the second largest gold exporter in Colombia, which provided over 45 tonnes of gold, valued at $1.4bn, to two American refineries, including Republic Metals Corp (RMC) in Miami.

The Colombian government accused the gold of being extracted illegally, moved through fake companies, and then used to clean money for criminal organizations. As a result, the company faced sanctions from the Colombian government and one of its suppliers was sent to the US to be charged with drug trafficking and money laundering. Following a probe by the US attorney’s office, RMC agreed to strengthen its internal money laundering policies. Goldex has since declared bankruptcy.

NTR Metals, a company based in Miami, was involved in a highly profitable case connecting it to Amazonian countries through its dealings with illegal gold and counterfeit ingots from Peru. The company admitted to not having a sufficient anti-money laundering program in place after facing charges for handling $3.6 billion (£3 billion) worth of these illicit materials.

The issue extended beyond Florida to Maryland, where ex-Peruvian leader Alejandro Toledo is accused of using purchased properties to conceal and launder $1.2 million in bribes from Odebrecht, a Brazilian construction company, in exchange for a contract to construct the cross-Amazon interoceanic highway and other ventures. Odebrecht has acknowledged giving bribes and a court in the US has directed the return of funds to Peru. Toledo maintains his innocence.

Several other investigations have connected a company based in Nevada to the illegal acquisition of timber from the Loreto area in the Peruvian Amazon, and a business in Connecticut to the clearing of forests for a palm oil plantation on indigenous territory.

Peruvian government regulators and watchdog groups have stated that their efforts to investigate environmental crimes often hit roadblocks when it comes to shell companies based in the US. According to Daniel Linares Ruesta, director of Peru’s financial intelligence unit, there have been instances where the source of illicit funds can be traced back to involvement with American companies.

The report highlights two primary issues with the US’s regulation of financial transactions from foreign countries: lenient requirements for identification that permit the use of anonymous shell companies, and significant gaps in the anti-money laundering system that allow real estate agents and refineries to accept payments without verifying or disclosing the source of the funds.

In 2021, the Igarapé Institute projected that illegal activities in the Amazon region produce yearly earnings totaling $110 billion to $281 billion. Despite this significant amount, financial agencies in Latin America have not placed a strong emphasis on addressing these crimes. Recent research by Insight Crime indicates that the issue may be worsening as connections are formed between illegal environmental activities, drug trafficking, and money laundering networks in Brazil, Colombia, Peru, and Ecuador.

The Fact report advises that the US should assume greater accountability as it is the top recipient of illicit funds, followed by the UK and its associated territories like the Cayman Islands.

The suggestions include the US government enforcing anti-money-laundering regulations in the real estate industry, aiding Amazon nations in strengthening financial supervision, and enacting the Corporate Transparency Act to create a registry of actual owners of all businesses. It also urges the US Congress to approve the Forest Act, which would include illegal deforestation as a form of money laundering.

Gary expressed optimism that the Biden administration acknowledged the danger of corruption. However, he emphasized the importance of taking action.

Gary stated that the US must take action. Our findings demonstrate the significance of the US addressing its financial secrecy practices and working with law enforcement allies in the Amazon region to fight against unlawful financial activities. The US’s financial secrecy poses a global issue.

Source: theguardian.com