Billionaires are notoriously difficult to track. It’s no surprise – the easier they and their assets are to find, the easier they are to tax. But by all accounts, the number of uber-wealthy people in China is in decline. Of the world’s estimated 2,640 billionaires, at least 562 are thought to be in China, according to Forbes, down from 607 last year.

Due to increased scrutiny of financial figures and a tumultuous political atmosphere, numerous wealthy individuals in China are seeking to relocate their assets and themselves outside of the nation.

Chinese high-ranking members have been seeking methods to move their wealth outside of the country for quite some time. The official limit for individuals to transfer funds out of China is $50,000 (£41,000) per year. However, affluent individuals have various legal and illegal means of transferring their money, such as utilizing currency exchanges in Hong Kong where capital controls do not exist, or channeling their funds into foreign enterprises.

In August, authorities in Shanghai apprehended five individuals employed by an immigration consulting firm, including the CEO, for allegedly aiding in unlawful foreign currency transactions totaling over 100 million yuan (£11,300). In an official statement released by state media, the police stated that these illicit activities significantly disrupt the financial market’s order in the country.

Prior to the outbreak of the pandemic, approximately $150 billion was being transferred out of China annually by tourists looking to take their finances abroad, according to Natixis, a bank. While global travel has yet to reach pre-pandemic levels, economists suggest that the combination of high interest rates in the US and a devalued yuan is a significant motivation for wealthy Chinese individuals to move their money out of the country.

During the initial six months of 2023, China’s balance of payments data showed a deficit of $19.5 billion, which is often seen by economists as a sign of capital outflow. However, the actual amount of money leaving the economy may be even greater, although it is not officially reported.

According to Alicia Garcia Herrero, the Asia Pacific chief economist at Natixis, the current state of economic policies and business prospects in China is causing considerable uncertainty. This has resulted in individuals choosing to withdraw their savings from the country.

In 2021, the Chinese leader Xi Jinping revived the concept of “common prosperity”, which was widely understood as a request for wealthy business leaders to distribute their money more evenly. During that same year, Jack Ma, the founder of China’s prominent tech company Alibaba, contributed 100 billion yuan towards this goal.

It is believed that Xi has a high level of suspicion towards China’s wealthy individuals, as over $600 billion left the economy in 2015 following a sudden devaluation of the yuan. As a result, the government has been working to increase control over the country’s wealth and those who possess the majority of it. The Chinese Communist Party (CCP) became especially concerned when prominent billionaires, such as Ma, began openly criticizing China’s regulatory system. After Ma’s remarks in 2020, he vanished from the public eye for several years.

The phrase “common prosperity” has become less prominent as Beijing strives to portray China as a welcoming destination for business, following three years of strict measures to combat Covid. However, the pressure on wealthy business leaders has not decreased. With borders now open, many are considering leaving the country. In the previous month, Hui Ka Yan, the founder of the troubled real estate company Evergrande and former wealthiest man in Asia, was arrested for unspecified offenses. Bao Fan, a well-known investment banker who was once highly influential in the technology deal industry, was taken into custody in February and has not been seen since. Other executives have been subjected to exit restrictions.

The current state of the environment is drastically different from the 1990s and early 2000s. During that time, China was focused on joining the World Trade Organization in 2001 and implementing various market reforms that enabled entrepreneurs to accumulate significant wealth. This period prioritized making money above all else. However, under Xi’s leadership, which has seen him gain more personal power than any leader since Mao, the focus has shifted back to political control instead of economic liberty.

According to Victor Shih, a professor of China’s political economy at the University of California San Diego, the current punishment being imposed on the wealthy class is unprecedented since the 1990s. This has caused many individuals in that class to consider expanding their investments outside of China.

There is a growing trend of affluent Chinese individuals moving to nearby popular locations. According to data from real estate company OrangeTee, over 10% of high-end condominiums sold in Singapore in the first quarter of 2021 were purchased by mainland Chinese buyers, a significant increase from approximately 5% in the same period in 2020. The number of single-family offices, which are firms established to oversee the financial assets of a particular family, has also risen in Singapore, with around 1,100 currently in operation compared to just 50 in 2018. It is estimated that half of this increase is attributed to Chinese clientele.

Affluent individuals from China are seeking options to relocate both themselves and their finances outside of the country. According to Henley & Partners, a firm specializing in immigration services, the number of high-net-worth Chinese individuals expected to leave China this year is 13,500, a significant increase from 10,800 last year.

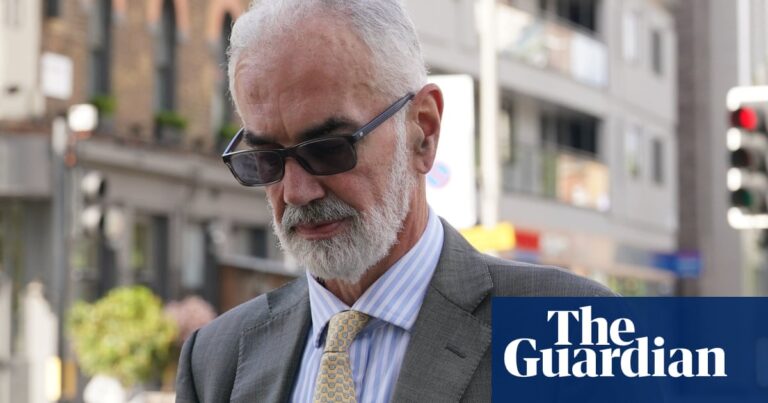

According to David Lesperance, an independent consultant who assists wealthy individuals with relocation, the Chinese government is serious about maintaining control, as demonstrated by the experiences of Jack Ma and others. As a result, it is important to consider methods for safeguarding both your finances and your overall well-being.

According to Lesperance, he is receiving more and more requests from business professionals who wish to relocate their entire teams from China, rather than just their families. In addition to concerns about political instability, entrepreneurs no longer see China as a promising business destination. In the past, China was producing two new billionaires per week, but now there has been a decline in economic growth.

Lesperance explains that previously, individuals were motivated to remain in China due to high profits. However, as profits have decreased, they are now questioning the reason for staying and the potential risks involved.

Source: theguardian.com