Cinephiles talk about the “MoviePass summer” with the same wistful nostalgia as hippies recalling the Summer of Love, like it’s an impossible dream so utopian that it might have been a collective hallucination.

In August 2017, the startup MoviePass – a company conceived to sell subscriptions under which users paid a monthly fee in exchange for movie tickets – announced a radical new pricing structure offering one admission a day for a paltry $9.95 each month. Moviegoers immediately realized that the service would pay for itself within a single use, and use it they did; attendance soared, particularly in metropolitan markets with robust repertory scenes, where obsessives enthusiastically accepted the implicit challenge to go to the pictures every day. One afternoon, to kill a few hours between appointments in Manhattan, I checked into a multiplex with MoviePass just so I’d have somewhere dark and cool to take a nap. On days when I didn’t plan on catching a screening, I’d check in anyway if I passed a theater, just to move some cash into the pocket of a valued local business. It was all Monopoly money anyway, not even real, or at least not real to the average consumer. Squaring the balance would be someone else’s problem.

Said problem metastasized into a full-blown quagmire as MoviePass racked up hundreds of millions in debt and scrambled to stave off the inevitable collapse fast approaching. New costs and throttled access came at increasingly regular intervals, notifying customers that they could only watch a certain handful of titles, or at specific times. Glitches proliferated and some showtimes simply vanished from availability, to the point that anyone with a brain surmised that management was frantically trying to jam a cork in the sinking ship. In 2019, an email blast informed subscribers that MoviePass would cease operations imminently, sealing the final failure of a company that now seems success-proof in its very premise.

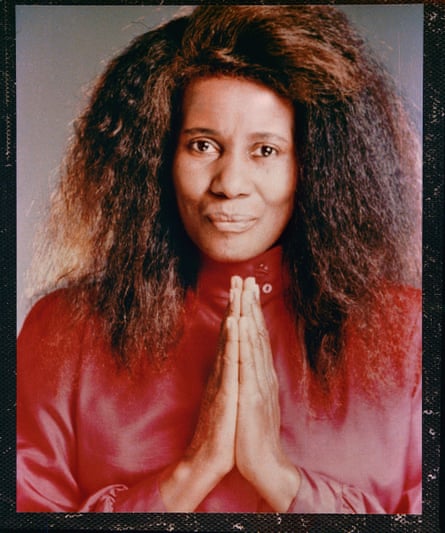

The new HBO Max documentary MoviePass, MovieCrash recounts this odd case study in modern entertainment economics, a shell game in which convincing investors of the potential for money in the future beats the reality of money today. The director Muta’Ali Muhammad largely missed the boat on the service’s heyday, hipped to it by a friend in 2018 as the company sank deeper into its chaos period. Muhammad asked her how much a MoviePass account would cost, and she realized that the terms and conditions had changed so many times, she didn’t know what to tell him. “That was the first moment when I thought that this sounded a little fishy,” Muhammad says.

Reading reportage from the journalist Jason Guerrasio (who is also credited as an executive producer on the documentary) in Business Insider, Muhammad saw a story for our times, a parable about reckless growth and the rapaciousness of private equity. And it had a pair of tragic heroes in Stacy Spikes and Hamet Watt, the idealistic young founders of MoviePass ousted following a sale to the data and analytics outfit Helios and Matheson, referred to by stock symbol HMNY. The rise and fall plays like The Social Network, charged by the razzle-dazzle mentality of showbiz and complicated by a sour angle of racial bias (Spikes and Watt are Black and those who took over are white).

“In the startup world, real humans fall in love with the idea of being a disruptor, at any expense,” Muhammad explains. “I think some people involved in this story like being able to publicly present themselves as a gamechanger or thought leader, without doing the grunt work of coming up with an innovative business model.”

The unveiling of the mind-boggling $9.95 plan came at the same time that MoviePass got in bed with big money, as an imminent need to grow its subscriber base motivated the deal with HMNY and the instatement of its CEO, Ted Farnsworth, in a key decision-making position. Along with the former Netflix executive Mitch Lowe, they wrested control of MoviePass from Spikes and Watt to enter a new era of profligate spending. The documentary recounts the follies of an expensive weekend of questionably effective promo alongside 50 Cent at Coachella, as well as the ill-fated foray into distribution as MoviePass Films brought the laughable John Travolta vehicle Gotti to the world.

“A lot of the players involved on the investment side came from various areas, and Stacy and Hamet, they had an original set of investors along for the ride since around 2011,” Muhammad says. “Once HMNY came onboard in 2017, that’s when the rollercoaster ride started. What I inferred from our interview with Hamet was that their investors were not happy. While some people made money from the rise and fall of HMNY stock, his investors didn’t.”

The documentary positions “Ted & Mitch” v “Stacy & Hamet” in a war for the future of MoviePass, with two finance-world con artists battling two relatively earnest guys trying to build something that could last. Where the original founders saw a labor of love, the new management saw a get-rich-quick scheme, which is exactly what they wanted to do, juicing the stock price in the hope that everything else would figure itself out later. All the while, they failed to address the bills mounting with each ticket price they fronted, totally blind to the fact that people like going to the movies and will do so as much as possible if allowed. “Mitch often compared it to a gym membership, but people don’t like going to the gym,” Muhammad says. “They get it, and they don’t want to use it. I have a gym membership right now that I don’t use.”

When the bottom fell out and everyone started looking for scapegoats to blame, Lowe and Farnsworth fit the role, having opened themselves up to fraud investigations by illegally depriving customers of the service they had paid to access. The pair still face pending trials, which made telling their story a somewhat dicier proposition for Muhammad. “That was a part of the story where legal contributed the most, in terms of the shape of what we can and can’t say,” he says. “This question on everyone’s mind has a lot to do with the charges facing Ted and Mitch that are still pending. But from what I’ve been told, I understand that Ted had a relationship with some of the hedge funds that were backing them. That’s legal, but hedge funds can make money even when a stock is going down.”

MoviePass, MovieCrash faced the unusual challenge of having to tell a story that hasn’t yet ended, and for all of its major players. As the venture vultures await their verdicts, Watt has moved on while Spikes has regained control of the company, leading to its first-ever year of profit. The documentary ends on a note of hope that a Black entrepreneur might get a fairer shake this time around, after watching in horror as a couple of opportunists burned the credibility he had spent years building. Ultimately, Muhammad sees this episode as an illustration of how the racialized perception of the typical CEO – a hyper-confident, older white man – can be fatal when used as cover for bush-league incompetence while cleverer, harder-working colleagues continue to labor in obscurity.

“I read that only 3% of Black and female entrepreneurs looking for VC funding get the capital,” he says. “That was an alarming stat. My big takeaway was that sometimes, the biases we have about other people, they can get us into trouble. They can make us believe in the wrong people and write off the right ones. This case study is emblematic of that dynamic.”

-

MoviePass, MovieCrash is available on Max in the US on 29 May with a UK date to be announced

Source: theguardian.com