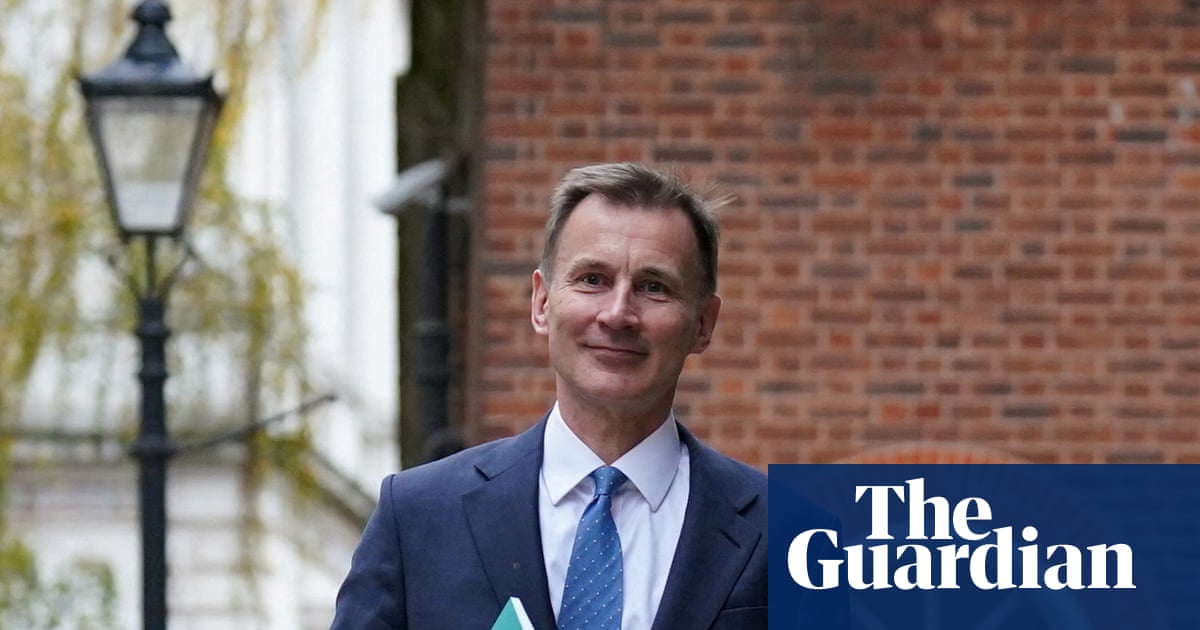

Jeremy Hunt received a positive increase in support, as the recent data on government spending revealed that the UK had its biggest monthly budget surplus in over three decades.

According to data from the Office for National Statistics (ONS), even though the economy is in a recession, the government’s tax income in January exceeded its spending by £16.7 billion.

The Office for National Statistics (ONS) reported that the surplus in government funds was significantly increased due to the deadline for self-assessed income tax payments at the end of the previous month, as well as lower interest payments on government debt. This surplus was more than double the amount of £7.5 billion in January 2023.

The financial markets had anticipated that the UK would have a larger surplus of £18.7bn last month. However, due to revisions made to previous data, borrowing for the first 10 months of the 2023-4 financial year amounted to £96.6bn. This was almost £10bn lower than the forecast by the Office for Budget Responsibility, which is responsible for monitoring government’s taxation and expenditure.

Jessica Barnaby, the ONS deputy director of the public sector division, said: “January’s surplus is the largest in nominal terms since monthly records began in 1993, although borrowing in the year to January is only slightly lower than the same period last year.

“Tax revenues in January are consistently higher compared to other months due to self-assessment taxes, resulting in a surplus.”

Barnaby stated that the decline in inflation, as determined by the retail prices index, has resulted in decreased payments for holders of government bonds. Additionally, the discontinuation of last year’s assistance for energy bills has led to a reduction in government expenditures.

The Office for National Statistics reported that the country’s debt relative to its economic output has risen and is currently at 96.7% of the gross domestic product (GDP) as of January, which is an increase of 1.8 percentage points compared to the same time last year.

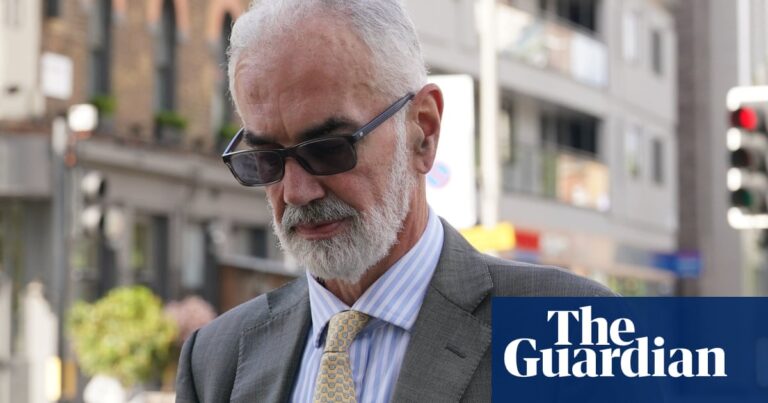

The borrowing numbers from the previous month will be the final ones before Hunt presents his budget on March 6th. Analysts believe that these figures will give the chancellor a bit more flexibility to decrease taxes.

According to Ruth Gregory, a UK analyst at Capital Economics, the public finance data for January has brought some positive developments for the chancellor prior to the budget. However, it is unlikely that this will lead to significant spending before the upcoming election.

Ignore the newsletter advertisement.

after newsletter promotion

It is predicted that the chancellor will have a budget surplus of only £15 billion (equivalent to 0.5% of GDP), which may restrict his ability to introduce significant tax cuts without proper funding, if he wants to follow the fiscal regulations.

The chief secretary to the Treasury, Laura Trott, said: “We provided hundreds of billions to pay wages, support business and protect lives during Covid, and to pay half of people’s energy bills after Putin’s invasion of Ukraine.

However, it is not feasible to burden future generations with the consequences of our actions. Therefore, we have made difficult choices to decrease borrowing compared to the predictions made by the OBR in March. We cannot predict if there will be more opportunities to lower taxes in the upcoming budget, but there are signs that the economy is improving as inflation has decreased from 11% to 4%.

Source: theguardian.com