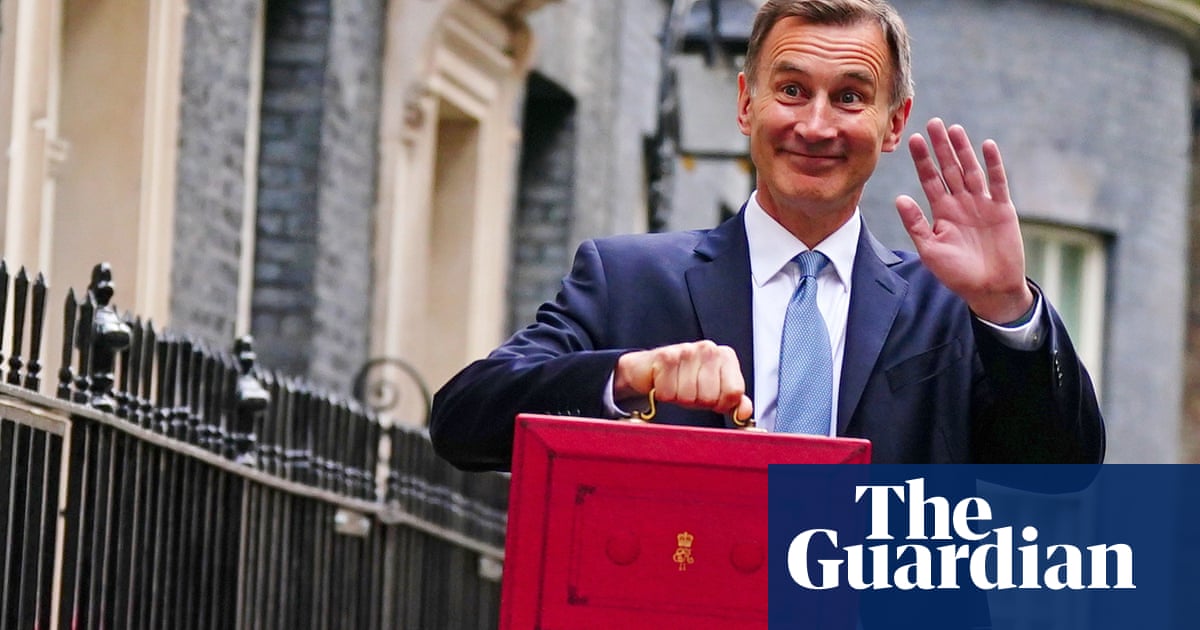

According to reports, Jeremy Hunt is contemplating getting rid of the non-domiciled tax regulations in the upcoming budget for Britain. This action would result in him adopting one of Labour’s significant fiscal strategies.

The choice is believed to be one of the potential avenues for generating income that were created for the chancellor and Rishi Sunak in response to lower economic projections, which have limited available funds for tax reductions or financial promises.

If the budget for next week includes this announcement, it would mean that the Conservatives are copying a policy from Labour, which Hunt has previously condemned.

Eliminating the non-domiciled tax system could generate approximately £3.6 billion annually.

On Wednesday, sources from the Treasury informed several newspapers that Hunt was considering getting rid of or reducing the tax break as one of the last-minute choices if the official predictions worsened in the coming days, further hindering the possibility of budget tax reductions. A spokesperson from the Treasury stated, “We do not provide comments on budget speculation before a fiscal event takes place.”

In 2022, the HM Revenue and Customs reported a total of 68,800 non-domiciled individuals in the United Kingdom for the tax year.

According to the current regulations, individuals who are not domiciled in the UK but live there can generate income from investments outside the country without being taxed for up to 15 years, as long as they do not transfer any earnings or profits back into the UK. This rule has been utilized by Akshata Murty, the wife of Sunak, to avoid paying millions in UK taxes.

According to an article from The Guardian, Labour intends to eliminate non-domiciled tax benefits and plans to provide a four-year window for current non-doms to adjust to the changes.

In 2022, the Labour party announced plans to eliminate tax breaks, citing research that indicates this action could generate an annual revenue of at least £3bn. Shadow chancellor Rachel Reeves has stated that completely scrapping the breaks would result in an annual increase of that amount, which the party would allocate towards expanding the NHS workforce.

One potential plan being explored by the party is the implementation of new regulations for individuals residing temporarily. One possibility being considered is granting individuals the opportunity to reside in the UK as non-domiciles for four years before being subject to full UK tax.

In November, the chancellor indicated that he was unaware of the potential earnings from eliminating the tax status.

Hunt stated that he preferred for wealthy individuals to remain in the country and contribute to the economy through spending. He mentioned that Treasury officials had expressed uncertainty about the potential financial gain of the proposed move.

Source: theguardian.com